Abstract

NFTs, which stands for Non-Fungible Tokens, have seen explosive growth in recent years for their involvement in the exchange of expensive digital items. However, it is important to note that NFTs are not a currency. Instead, they are tokens that can represent any virtual good and prove their uniqueness and authenticity. Therefore, these tokens facilitate the buying and selling of virtual assets such as digital paintings, songs, or even animated GIFs. For instance, buying an NFT digital painting means that a buyer is buying a token that is tied to the digital painting, not the painting itself. NFTs possess the ability to provide indisputable ownership and act as a proof of authenticity for virtual goods, thus making them very valuable as they play an important role in securitizing future online transactions and preventing fraud. Ultimately, the existence of NFTs has significant implications on our journey into a truly secure and futuristic society.

NFT 101: Intro to Non-Fungible Tokens

NFTs, which stands for Non-Fungible Tokens [1], have been making headlines all over the world for their role in the sale of various expensive digital assets. From an animated cat GIF that sold for $561,000, the final bidding price of Jack Dorsey’s first Twitter tweet for almost $3 million [3], to a $69 million collage of digital drawings [2]. With many more other digital art creations being sold as NFTs on popular platforms such as OpenSea.io, NFTs are clearly taking the world by storm and simply cannot be ignored. But what makes them so popular? More importantly, why are they capable of being so valuable?

Figure 1. Examples of NFTs

To understand these tokens, we must first explore the term “non-fungible”. This term describes things that are unique and cannot be exchanged for an equivalent, like a custom-made wedding ring, limited edition trading card, or art pieces. [1]. For instance, ten $1 bills and one single $10 bill are completely equivalent and interchangeable, hence the dollar is fungible.

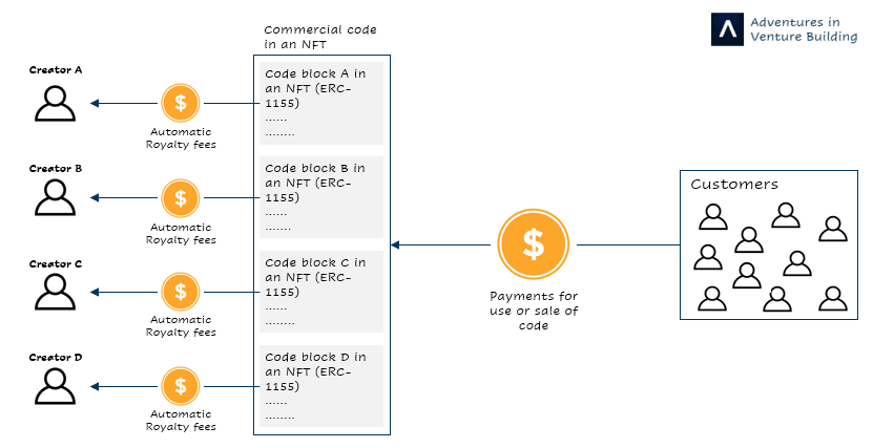

Smart Contracts and Benefits

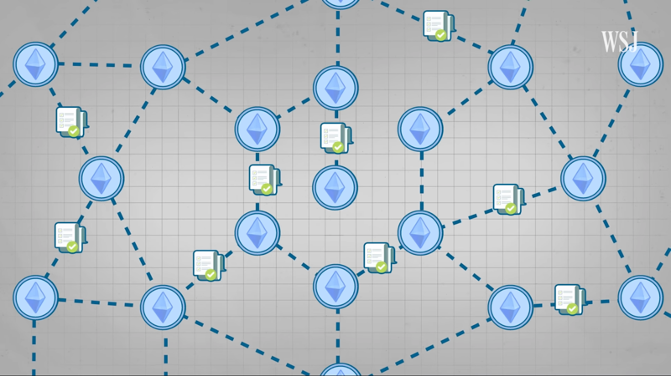

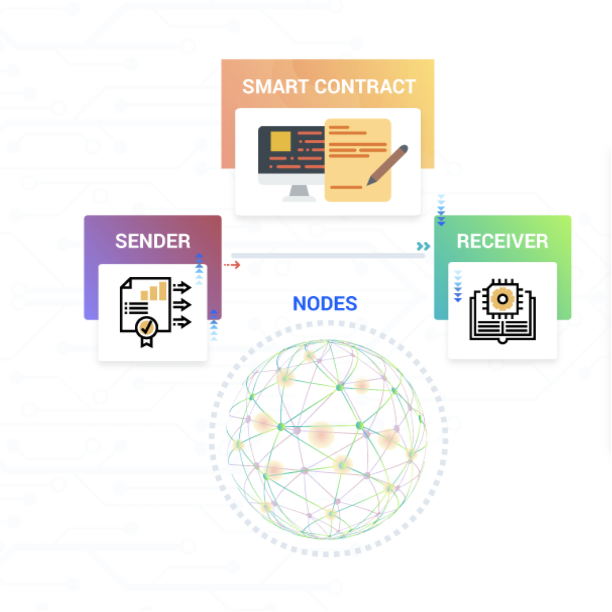

When someone buys an NFT, the metadata of the NFT, such as token ID number, date of creation, and transaction price, all belong to that buyer. The token’s ownership and resale is then governed by something known as smart contracts.

Aftermarket of Digital Personal Property

Many have seen news of people selling rare coins, stamps, and other limited or special edition items for astronomical prices. One such item, a Pikachu Trading card from the popular animation Pokémon, sold for $224,250. All of these rare and unique items derive their value from scarcity [10]. In the case of the card, only 39 cards were created in the late 1990s, with very few copies surviving today [11]. This makes them somewhat one-of-a-kind to interested buyers, and they are willing to make offers that they believe would justify the value of owning such a unique asset.

However, if an original copy of the card was to be sold as an NFT virtually, then no matter who saves a picture of the card on their device, the picture still belongs to the person who bought the token because the NFT contains the unique metadata of the card and is securely stored on a digital ledger. A simple example of this scenario is going to an art gallery in which anyone can take pictures of the displayed art, but clearly none of them owns the actual art, until it is taken off the wall and sold to a buyer. And with NFTs, this system is able to exist online.

Since NFTs can brand virtual goods as unique and provide proof of ownership, second-hand and resale markets for virtual assets can exist and thrive. Just as a physical car possesses second-hand value, buyers of virtual assets are now able to place a resale value on their digital assets, some of which may even increase in value just like the limited-edition Pokémon cards [10].

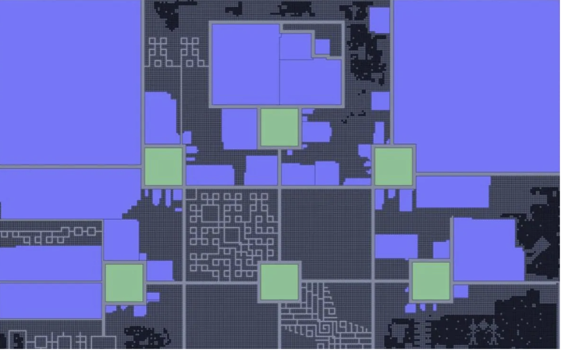

Alice in Decentraland

Decentraland is an online multiplayer game, where players can control and move their personalized avatars around the 3D virtual space and interact with other players. Had Alice fallen into Decentraland through the rabbit hole instead of Wonderland, she would find herself immersed in a futuristic, digital realm that mirrors the real-world, capitalist society we live in.

Into the Future

With the Covid-19 pandemic acting as a catalyst to accelerate the digitization of the world, NFTs and their use of blockchain and smart contracts will play a crucial role in building a safer digital environment. As these tokens become more widely adopted by netizens across the globe, there will certainly be new standards in creating more secure NFTs to utilize their full potential. From peer to peer lending that automatically transfers funds to the lender, to a thriving digital market for all sorts of virtual assets, not only will these transactions be more secure than ever, they will also lay the foundation for rebuilding trust among individuals. In a world with plenty of fraud, piracy, defaults and other deviant behaviors that abuse trust, NFTs could take on the role of protector and enforcer of ethical business conduct. Eventually, NFTs may even be used for the ownership of tangible items in the real world, such as a home or a car [6].

References

[1] Finematics, “What Are NFTs and How Can They Be Used in Decentralized Finance? DEFI Explained” Youtube, 29 Sep. 2020. [Video Recording]. Available:

https://www.youtube.com/watch?v=Xdkkux6OxfM&t=85s [Accessed: April 15, 2021].

[2] Sarah Cascone, “Here Are the 10 Most Expensive NFT Artworks, From Beeple’s $69 Million Opus to an 18-Year-Old’s $500,000 Vampire Queen,” Artnet, March 23, 2021. [Online].

Available: https://news.artnet.com/market/most-expensive-nfts-1952597 [Accessed: April 15, 2021].

[3] Taylor Locke, “Jack Dorsey sells his first tweet ever as an NFT for over $2.9 million,” CNBC, March 22, 2021. [Online]. Available: https://www.cnbc.com/2021/03/22/jack-dorsey-sells-his-first-tweet-ever-as-an-nft-for-over-2point9-million.html [Accessed: April 15, 2021].

[4] Wall Street Journal, “NFTs are fueling a boom in digital art. Here’s how they work,” Youtube. [Video Recording]. Available: https://www.youtube.com/watch?v=zpROwouRo_M [Accessed: April 18, 2021].

[5] U. W. Chohan, “Non-Fungible Tokens: Blockchains, Scarcity, and Value,” Critical Blockchain Research Initiative (CBRI) Working Papers, March 24, 2021, pp.3-5. Available: SSRN: https://ssrn.com/abstract=3822743 [Accessed: April 17, 2021].

[6] 101 Blockchains, “Non Fungible Tokens (NFTs): A Complete Guide,” 101 Blockchains, September 2, 2021. [Online]. Available: https://101blockchains.com/non-fungible-tokens-nft/ [Accessed: April 16, 2021].

[7] Hashcash Consultants, “What are Smart Contracts,” Hashcash Consultants, n.d. [Online]. Available: https://www.hashcashconsultants.com/smart-contracts-blockchain [Accessed: April 17, 2021].

[8] S. D. Levi and A. B. Lipton, “An Introduction to Smart Contracts and Their Potential and Inherent Limitations,” Harvard, May 26, 2018. [Online]. Available: https://corpgov.law.harvard.edu/2018/05/26/an-introduction-to-smart-contracts-and-their-potential-and-inherent-limitations/ [Accessed: April 16, 2021].

[9] Abhishek Kumar, “Smart Contracts On The Blockchain: A deep dive into Smart Contracts,” Medium, April 30, 2018. [Online]. Available: https://abhibvp003.medium.com/smart-contracts-on-the-blockchain-a-deep-dive-in-to-smart-contracts-9616ad26428c#:~:text=A%20smart%20contract%20is%20a%20computer%20code%20running%20on%20top,to%20interact%20with%20each%20other.&text=The%20smart%20contract%20code%20facilitates,of%20an%20agreement%20or%20transaction. [Accessed: April 17, 2021].

[10] J. Fairfield, “Tokenized: The Law of Non-Fungible Tokens and Unique Digital Property,” Indiana Law Journal, Forthcoming, April 6, 2021, pp.25. Available: https://ssrn.com/abstract=3821102 [Accessed: April 17, 2021].

[11] Ross Uitts, “20 Most Expensive Pokemon Cards of All Time,” Old Sports Cards ,March 24, 2021. [Online] Available: https://www.oldsportscards.com/most-expensive-pokemon-card/ [Accessed: April 27, 2021]

[12] Imad E. Fay, “The rise of NFTs and what it could mean for the collaboration economy,” Menabytes. March 28, 2021. [Online] Available: https://www.menabytes.com/rise-of-nfts/ [Accessed: April 15, 2021].

[13] S. Chevet, “Blockchain Technology and Non-Fungible Tokens: Reshaping Value Chains in Creative Industries,” May 10, 2018, pp.58-59. Available: https://ssrn.com/abstract=3212662 [Accessed: April 17, 2021].

[14] Olga Khariff, “Virtual-Reality World Turns Digital Currency Into Cold Cash,” Bloomberg, February 20, 2020. [Online] Available: https://www.bloomberg.com/news/articles/2020-02-20/virtual-reality-world-turns-digital-currency-into-cold-cash [Accessed: April 20, 2021].

[15] CBC, “Welcome to Decentraland, where investors spend real-world dollars flipping virtual real estate,” CBC, Feb. 15, 2019. Available: https://www.cbc.ca/radio/day6/episode-429-snc-lavalin-s-lobbying-professional-axe-throwing-virtual-real-estate-lorena-bobbitt-and-more-1.5019261/welcome-to-decentraland-where-investors-spend-real-world-dollars-flipping-virtual-real-estate-1.5019287 [Accessed: April 15, 2021].

[16] Oshrat Carmiel, “Virtual Land Prices are Booming, and Now There’s a Fund for That,” Bloomberg, March 19, 2021. [Online] Available: https://www.bloomberg.com/news/articles/2021-03-19/virtual-land-prices-are-booming-and-now-there-s-a-fund-for-that#:~:text=The%20most%20expensive%20deal%20ever,Axie%20Infinity%2C%20according%20tVirtual Land Prices are Booming, and Now There’s a Fund for Thato%20NonFungible. [Accessed April 16, 2021].