Imagine waking up late for an important meeting, scrambling to get ready, only to realize you haven’t prepared anything yet. Your ID, your phone, or even the credit card that you set aside to grab coffee on the way are scattered all over your apartment. You waste precious minutes gathering everything, then you see the bus leaving right before you. Wouldn’t it be so much easier if everything we needed was in one place? Luckily for us, in today’s tech-driven world, there is a solution for people who value convenience and efficiency: the digital wallet.

A digital wallet (or electronic wallet) is an application on an electronic device that stores payment information and allows you to securely make purchases [1]. It has become so common that we rarely see people use physical cards or cash anymore. In this fast-paced digital world, contactless payments become increasingly popular, and it is essential for us to understand the technology behind it. This knowledge not only helps us stay aligned with this evolving technology but also allows us to evaluate if these tools are safe and beneficial for everyday use. This article will explore more about how these technologies work and how they contribute to the growth of digital payments, specifically digital wallets.

Revolutionizing the Way We Pay

The rise of digital wallets has revolutionized the way we conduct transactions, making the process of purchasing goods and services more convenient and secure for users around the world. By streamlining the payment process, digital wallets significantly enhance efficiency in financial transactions and reduce the time spent handling cash and credit cards. Users can also store multiple cards in one single app, eliminating the need to carry various physical cards and reducing the risk of loss or theft.

For users, the features offered by digital wallets mean faster checkouts, especially during online shopping or contactless payments at stores. They also allow users to store a wide range of digital items, such as gift cards, coupons, and plane tickets, all within one convenient application. Merchants can also benefit from digital wallets, which allow quicker transaction processing, leading to shorter queues and improved overall customer satisfaction. Moreover, digital wallets help businesses cut costs by reducing the need for expensive point-of-sale systems [2]. By facilitating quick and secure payments, digital wallets attract many people to use them.

The popularity of digital wallets has soared due to the rapid growth of e-commerce and advancements in mobile technology. This trend became even more significant during the COVID-19 pandemic, due to the increasing demand for contactless payments as people were required to minimize physical contact for safety measures and reduce the spread of the virus. Digital wallets were able to cater to this change in our new normal. It also provides an alternative way to make transactions, especially with the growing preference for online shopping and digital convenience [3]. Without a doubt, digital wallets are now an essential tool in modern digital commerce.

How Digital Wallets Work

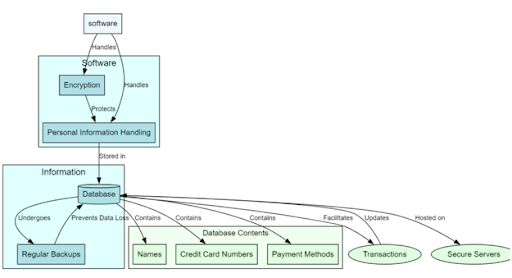

The technology behind digital wallets comprises two primary components: software and information. Each of them plays a crucial role in ensuring secure and efficient transactions.

The information component acts as a database where all the data, including names, payment methods, and credit card numbers, are stored [4]. This component ensures accurate fund transfers between two parties by facilitating effective transactions. Its database is hosted on secure servers and undergoes regular backups to ensure no data is lost during a cyber attack or system failure. However, no system is foolproof, and users must remain vigilant in protecting against cyberattacks.

The other component is the software component that guarantees the proper handling of users’ data and data security through encryption, which involves safeguarding sensitive user information from unauthorized personnel during the transaction process [4]. Encryption works iby scrambling private financial information data into unreadable codes. It then can only be accessed or unlocked by a corresponding digital key. Think of it like playing the crack-the-code puzzle but with millions of different possibilities [5].

Figure 1: The information and software components of digital wallets [4]

To use the digital wallet, a user first enters their card information into a digital wallet app or website. Different digital wallets sometimes use an initial security measure before users can access the app or site. Examples are entering passcodes, fingerprint scans, or even facial IDs. When the card becomes linked to the digital wallet, the software will handle encryption to keep this information safe. After it is processed, the card information will be stored in the database of the digital wallet, and users are free to complete transactions securely [6].

During a transaction, a payment gateway, receives the payment request from a particular digital wallet application and connects the request to the payment processor [7]. For instance, imagine you are buying a latte at your favorite coffee shop using your digital wallet. When you pay and confirm the transaction, the payment gateway will receive your request and forward it to the payment processor, which handles the actual transfer of funds.

At this point, your digital wallet has already verified your credential details, and the balance in the account is confirmed to ensure a successful payment process. If the balance is sufficient, the transaction is authorized, and the amount is transferred out of the account. The money is then routed to the merchant’s bank account through the payment network, such as Visa or Mastercard [7].

Once the transfer is complete, the status of the transferred amount is then communicated back to the gateway, informing the merchant’s system that the payment is processed successfully [6]. After that, your account will be updated with your final balance once the transaction is processed, and the merchant can hand over your latte.

Payment in a Single Tap

One of the key technologies behind digital wallets is Near Field Communication (NFC). NFC is a wireless communication protocol that allows devices like smartphones to communicate with NFC-enabled payment terminals. This allows most digital wallets to complete transactions with just a single tap [8].

Consumers have seen an upward trend in the adoption of Near Field Communication (NFC) for contactless technologies, unlike other options such as Bluetooth and Quick Response (QR) codes. Although QR codes are easily accessible by most smartphones, most consumers perceive the NFC contactless as a more secure and convenient payment method [2]. With the integration of NFC in digital wallets, it eliminates the need to carry physical cash that can be easily lost or stolen. Additionally, it comes with many higher-level security features such as encryption and two-factor authentication that safeguard user’s data from unauthorized persons [4]. Unlike Bluetooth, NFC only works in short range. This is actually the better option for contactless payments as it reduces the risk of interception from any third parties [8]. Thus, NFC provides a secure and seamless payment process for all users.

NFC operates on the principle of electromagnetic—two NFC-enabled devices generate a small magnetic field when placed near each other. This enables data to be exchanged without physical contact [9]. Smartphones usually have a NFC chip, which connects to other devices that are also NFC-based, like the payment terminals. With a single tap, data is successfully exchanged and payment is completed.

According to a study by ABI Research, 80% of respondents reported using a smartphone or smartwatch to make their payments [10]. The success of the NFC contactless has mainly been credited to its security and reliability. The more people become familiar with this technology, the higher the demand for advanced applications. This has led to the development of transformative solutions, such as multi-purpose taps that enable multiple transactions with a single tap. Additionally, other advancements like digital identities, digital product passports, and enhanced access control have also been introduced to make these systems more user-friendly [9].

Ensuring Users’ Safety

While a lot of security measures have been put in place to protect digital wallets, data compromises remain a major problem. According to the Identity Theft Resource Center, the US market reported 2116 data breaches involving digital wallets in the first three quarters of 2023 [11]. Data breaches are mainly propelled by cyber-attacks, with phishing being the main cause.

New application models with additional programming interface endpoints, pages, and users also encourage cyberattacks by creating a larger attack surface for hackers and other cybercriminals [12]. Furthermore, apps involved in digital wallets are more prone to attacks since hackers can easily exploit security oversights, and these systems are harder for administrators to monitor effectively. A major point of vulnerability is open banking, which most fraudsters use as a point of attack [11]. Because different developers have different security requirements, inconsistent security standards and issues with identity verification, such as credential stuffing, may increase digital wallets’ risk of attacks.

However, other than encryption, digital wallets also rely on tokenization as a key security measure. Just like its name, tokenization is the process of protecting sensitive card data, such as the Primary Account Number (PAN), expiry date, and security code, by replacing it with a randomly generated substitute data called a token. It disguises data with a random code, and the original data is recorded in a secure “codebook” called the vault [12].

Tokenization is not just for digital wallets, as it is a standard security measure [12]. A certified digital wallet provider (like Apple Pay or Alipay) will request tokenization of the user’s card details from the card network and store the tokenized card. It ensures user safety, so that digital wallets can conduct transactions without exposing the actual card information [13]. According to Visa’s CEO, “tokenization is the biggest change that’s been made in the payment networks easily over the past 15 or 20 years and maybe longer.”

Figure 2: A visualization of tokenization [14]

An Example in Apple Pay

Notable achievements in the digital wallet sector include giant companies like Apple, which has significantly embraced digital wallets in their Apple Pay service through Apple Wallet. Apple Wallet is automatically installed on every iPhone and allows users to store their credit and debit cards easily.

Apple Pay is one of the most user-friendly digital wallet apps out there. With just a single tap, users can complete transactions efficiently. Apple Pay enables users to pay with any of the cards in their Apple Wallet, either online or by holding their phone near a near-field communication (NFC) terminal. To ensure users’ privacy, Apple Pay uses tokenization. The system only saves users’ “token”, making sure it never exposes users’ financial data [15]. Before the transaction proceeds, Apple Pay asks for the user’s authorization, usually with Touch ID or passcode.

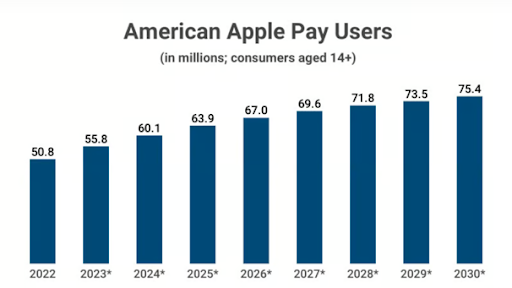

In 2021, consumers made $91.7 billion in physical Apple Pay purchases, up 96% from $46.9 billion in 2019. In 2024, 6 out of 10 Americans use Apple Pay in stores and nearly 4 out of 10 use it online [16].

Figure 3: Statistics of American Apple Pay Users [16]

The Future: Digital Currencies

As digital payments become more integrated into the global economy, countries are also beginning to explore digital currencies [17]. Digital currency is any currency that is available exclusively in electronic form. It is not the balance you have in your bank mobile app, which is more commonly known as electronic currency and can easily be transformed into physical dollars. Digital currency, however, never leaves a computer network and is exchanged exclusively through digital means [18].

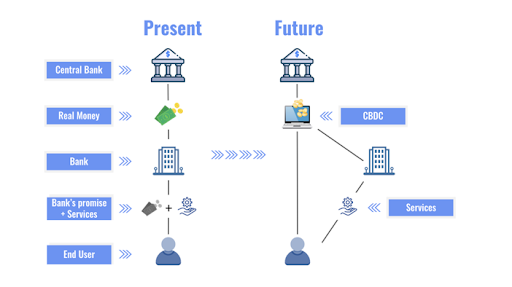

The two most used digital currencies right now\are cryptocurrency and central bank digital currency (CBDCs).

Cryptocurrency received its name because it uses encryption to verify transactions. It requires advanced coding to process its transactions between digital wallets and public ledgers. It operates on a distributed public ledger called blockchain, which records all transactions made by currency holders [17]. Data is stored in blocks that are linked together to form a chain, hence the name. New units of cryptocurrency are created through mining, a process that uses computer power to solve complex mathematical problems. Bitcoins is one example of cryptocurrency—it was the first and remains the most widely used cryptocurrency today [19].

CBDCs act the same way as cryptocurrencies, they are managed and issued by the government. Nearly every central bank in the world is on the verge of developing its own digital national coin [6]. Some countries that have already implemented CBDCs in their daily lives include the Central Bank of The Bahamas (Sand Dollar), the Eastern Caribbean Central Bank (DCash), the Central Bank of Nigeria (e-Naira), the Bank of Jamaica (JamDex), the People’s Bank of China (e-Yuan), and many more [18]. The European Central Bank (ECB) is also expected to make a decision on implementing a CBDC in late 2025, and Tte United States is currently in the research phase for a CDBC [20]. Since CDBCs are relatively new, many countries are still in the process of implementing them in a way that would ensure privacy and security for users.

Figure 4: The future of monetary system with CDBCs [20]

Digital wallets not only provide services with digital currencies, but also allow users to store and manage them—another reason to use digital wallets. While not every digital currency is supported by these wallets, many popular ones are still accessible and usable. Since convenience is always a top priority, the integration of digital wallets and digital currencies has made managing finances much simpler and more efficient.

Conclusion

In this ever-evolving world, the technology of digital wallets has continued to advance over the years. However, there is a crucial need to assess the existing gaps that hinder its full effectiveness and put fintech companies at risk of attack. In the future, the digital wallet sector should ensure devices have security measures to allow early detection of risky activities and attacks. It is also important to increase awareness of such attacks, mainly among developers and customers, to prevent future risks. Everyone is responsible for ensuring they have the proper knowledge and mechanisms to thrive in the new world of banking. Despite the risks, digital wallets offer far more benefits in terms of effectiveness and security, hence, making their use worthwhile.

Further Readings:

- Pros and Cons of Digital Wallets:

- What’s Next?

- More on Apple Pay Statistics by Capital One Research

- https://capitaloneshopping.com/research/apple-pay-statistics

References

[1] J. Kagan, “Investopedia,” 30 June 2024. [Online]. Available: https://www.investopedia.com/terms/d/digital-wallet.asp. [Accessed September 2024].

[2] M. Friedman, “The New Way to Pay,” Arkansas Business, vol. 31, no. 44, p. 1, 2014.

[3] ChatGPT. (GPT-4). OpenAI. Accessed: Sep. 26, 2023. [Online]. Prompts Used: “Why do people prefer to use Digital Wallets, How does NFC work to operate digital wallets.” Available: https://chatgpt.com/

[4] S. Agrawal, “Integrating Digital Wallets: Advancements in Contactless Payment Technologies,” International Journal of Intelligent Automation and Computing, vol. 4, no. 8, pp. 1-14, 2021.

[5] J.-P. Aumasson, Serious Cryptography: A Practical Introduction to Modern Encryption, San Francisco: William Pollock, 2018.

[6] K. Yasar, “What is a Digital Wallet?,” TechTarget, August 2022. [Online]. Available: https://www.techtarget.com/whatis/definition/digital-wallet. [Accessed September 2024].

[7] J. Yomas and C. K. N, “A Critical Analysis on the Evolution in the E-Payment System, Security Risk, Threats and Vulnerability,” Communications on Applied Electronics, vol. 7, no. 23, pp. 21-29, 2018.

[8] E. H. Wadii, J. Boutahar and E. G. Souhail, “NFC Technology for Contactless Payment Echosystems,” International Journal of Advanced Computer Science and Applications, vol. 8, no. 5, pp. 391-397, 2017.

[9] M. Cocosila and H. Trabelsi, “An integrated value-risk investigation of contactless mobile payments adoption,” Elsevier, vol. 20, pp. 159-170, 2016.

[10] Business Wire, “NFC Technology Driving Shift From Contactless Card to Device First Approach – ABI Research,” The AI Journal, vol. 1, p. 1, 2024.

[11] P. Lucas, J. Stewart and K. Woodward, “The Top 10 Most Pressing Issues in E-Payments,” Digital Transactions, vol. 20 , no. 11, 2023.

[12] A. J. Levitin, “PANDORA’S DIGITAL BOX: THE PROMISE AND PERILS OF DIGITAL WALLETS,” University of Pennsylvania Law Review, vol. 166, no. 2, pp. 305-376, 2018.

[13] M. Lamond, “What is digital wallet tokenization?,” Checkout, 2 November 2023. [Online]. Available: https://www.checkout.com/blog/digital-wallet-tokenization. [Accessed September 2024].

[14] S. Boboev, “Real-Time payments market landscape,” Fintech Wrap Up, 8 May 2024. [Online]. Available: https://www.fintechwrapup.com/p/real-time-payments-market-landscape. [Accessed September 2024].

[15] H. Logan, “What Is Apple Pay?,” 28 March 2024. [Online]. Available: https://www.nerdwallet.com/ca/credit-cards/what-is-apple-pay. [Accessed September 2024].

[16] Capital One Shopping Research, “Apple Pay Statistics,” 15 July 2024. [Online]. Available: https://capitaloneshopping.com/research/apple-pay-statistics. [Accessed September 2024].

[17] D. Graham, Integrated Electronic Payment Technologies for Smart Cities, Fort Pierce: Springer, 2023.

[18] D. Rodeck, “Digital Currency: The Future Of Your Money,” Forbes, 13 May 2024. [Online]. Available: https://www.forbes.com/advisor/investing/cryptocurrency/digital-currency/. [Accessed September 2024].

[19] Kapersky, “What is cryptocurrency and how does it work?,” Kapersky, 2024. [Online]. Available: https://usa.kaspersky.com/resource-center/definitions/what-is-cryptocurrency. [Accessed September 2024].

[20] M. Lal and A. Jatav, Digital Currencies in The New Global World Order, Palgrave: Macmillan, 2024.